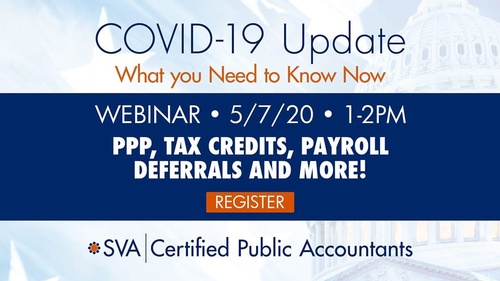

Whether your business is fully or partially operational or temporarily closed, we know everyone is impacted by COVID-19. For the past month, much of the focus has been on the Paycheck Protection Program (PPP) as business owners rush to understand what funds might be available to them. But don’t overlook other opportunities available to help with cash flow including utilizing tax losses, tax credits, or deferrals. As part of SVA’s commitment to keeping business owners up to date on new legislation and IRS regulations, our May webinar will focus on the top things business owners should be discussing with their CPAs.

Our team will discuss the relevant updates and issues including:

- PPP Loan Tracking and Forgiveness

- Accelerating COVID-19 Related Losses to Your 2019 Tax Returns

- Qualified Improvement Property (QIP) Bonus Depreciation Opportunities

- FMLA Payroll Tax Credits

- Deferral of Employer Social Security Taxes to 2021 and 2022

- Q&A Opportunity for Attendees

- Eric Trost, CPA, MST, Principal, SVA Certified Public Accountants

- Dan Glomski, CPA, ABV, CVA, MST, Principal, SVA Certified Public Accountants

- Nancy Mehlberg, CVB, EA, Principal, SVA Certified Public Accountants